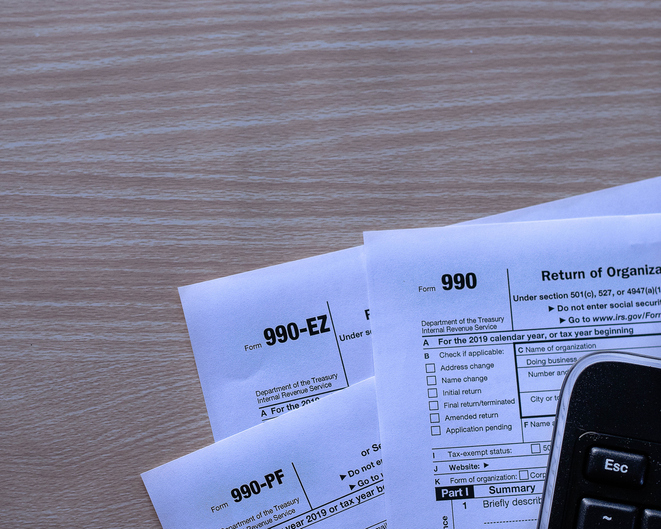

November doesn’t come to mind when you think of your time-consuming tax filing responsibilities, but the Form 990 deadline is approaching for non-profits and other organizations. Although nonprofits do not pay federal taxes, they are required to file an information return annually to the IRS. This return, Form 990, is officially known as the “Return of Organization Exempt from Income Tax” and provides the public with financial and other information about a nonprofit organization. Even though organizations may be tax-exempt, they may still be liable for tax on their unrelated business income.

How does Form 990 add value for the organization and its supporters?

The 990, which must be made public, provides an easy, convenient way for donors and other people interested in supporting a particular cause to identify and evaluate the best nonprofits to support. When the form is filed, this critical information is available to the public:

- Because an organization can clarify its mission on the Form 990 and detail its accomplishments of the previous year, donors can find out where the group generates and spends its revenue.

- The form collects comprehensive information about the mission, programs, and finances of the nonprofit and provides an opportunity to report what it accomplished the prior year, thus making a case for keeping its tax-exempt status.

- A donor foundation can see just how sustainable the nonprofit might be by having access to its cash reserves, which demonstrate for potential donors and employees how well the nonprofit pays its top employees and how financially stable it is.

- Form 990 provides insights that can be used by potential board members, allowing them to see who currently serves on the board.

- Form 990 collects even more information, such as disclosure of potential conflicts of interest, compensation of board members and staff, and other details having to do with financial accountability, governance, and avoidance of fraud.

Since this form supplies such critical information and data about the organization, it is easy to see that it can be a great public relations tool for the group when it is filled out correctly, carefully, and on time. The deadline for the Form 990 is due the 15th day of the 5th month following the end of the organization’s fiscal year. The due date for organizations whose fiscal year is June 30th is November 15, 2021.

Which nonprofit organizations must file Form 990?

- All private foundations, regardless of income file Form 990-PF

- Most tax-exempt organizations with gross receipts of $200,000 or assets in excess of $500,000

- Nonprofits that have gross receipts of more than $50,000 may file Form 990 or Form 990-EZ

- Small nonprofits with gross receipts of $50,000 or less must file the 990-N (e-Postcard) to maintain their exempt status

- Organizations that are tax-exempt under Sections 501(c), 527, or 4947(a)(1) of the U.S. tax code, and that doesn’t fall into the exemptions listed below

What organizations are exempt from filing Form 990?

- Churches and most faith-based organizations, such as religious schools, missions, or missionary organizations affiliated with a church or faith-based organization

- Subsidiaries of other nonprofits, where there may be a group return filed by the parent group

- Nonprofits not in the system yet. An incorporated nonprofit or an unincorporated nonprofit in the state that doesn’t plan to apply to the IRS for exemption from federal income tax, don’t have to file a Form 990.

What happens if a nonprofit doesn’t file?

It’s important that all organizations never neglect to both file the Form 990 and to do so on time. If an organization does not file a Form 990 for three years in a row, its tax-exempt status will be automatically revoked by the IRS.

Many nonprofits have lost their tax-exempt status in recent years because they did not file a 990 as required. These are often small nonprofits that did not realize that even with receipts under $50,000, they must file the 990-N. The 990-N is a postcard with minimal information that can be filed electronically.

Don’t miss filing deadlines! Remember the consequences for not filing are steep. In fact, penalties for not filing timely can be as much as $100 per day with a maximum penalty of $51,000.

What you need to know about UBIT?

For most nonprofit organizations, unrelated business income (UBIT) is income from a trade or business, regularly carried on, that is not substantially related to the charitable, educational, or other purpose that is the basis of the organization’s exemption. An exempt organization that has $1,000 or more of gross income from an unrelated business must file. An organization must pay estimated tax if it expects its tax for the year to be $500 or more.

The obligation to file Form 990-T is in addition to the obligation to file the annual information return, Form 990, 990-EZ or 990-PF. Each organization must file a separate Form 990-T, except title holding corporations and organizations receiving their earnings that file a consolidated return under Internal Revenue Code section 1501.

As a preferred service provider for the Nonprofit Association of the Midlands, a collaboration of over 150 nonprofit agencies, our professional team will work hard to understand your organization’s mission and goals. Hayes & Associates is here to answer any questions you may have about UBIT and Form 990.